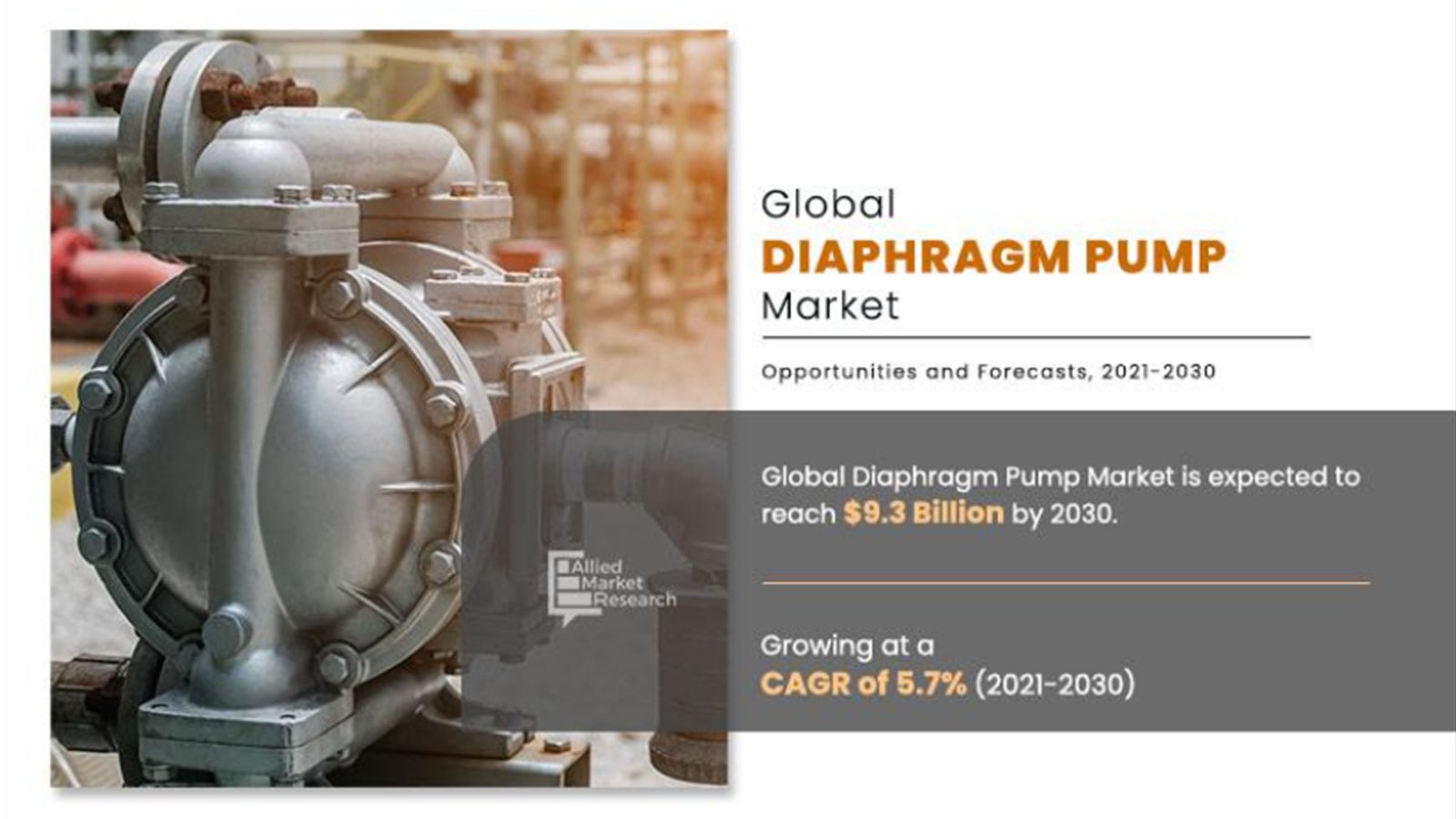

According to a new report published by Allied Market Research, titled, the global diaphragm pump market size was valued at $5.4 billion in 2020, and global diaphragm pump market forecast projected to reach $9.3 billion by 2030, growing at a CAGR of 5.7% from 2021 to 2030.

The global diaphragm pump market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include Dover Corporation, Flowserve Corporation, GemmeCotti Srl, Graco Inc., Grundfos Holding A/S, IDEX Corporation, Ingersoll Rand, LEWA GmbH, Tapflo AB and Xylem.

A diaphragm pump is a hydraulically or mechanically actuated positive displacement pump that uses a combination of reciprocating action and either a flapper valve or a ball valve to transfer liquids. Diaphragm pumps are self-priming and are ideal for viscous liquids. Virtually all major industries utilize diaphragm pumps and are commonly used to move abrasive fluids, including concrete, or acids and chemicals. They are also common in automobiles and aircraft. In addition, diaphragm pump is also known as a membrane pump, air operated double diaphragm pump (AODD) or pneumatic diaphragm pump. Diaphragm pumps use the up-and-down movement of a cupped, elastic surface to generate liquid flow. This surface, found within the pump, is typically made from polytetrafluoroethylene (PTFE), Teflon, synthetic rubber or a similar material. When the surface is pushed into the liquid, it adds pressure and displaces a certain amount of fluid. When it is pulled back from the liquid, it draws in more fluid. The diaphragm pump uses check-valves to prevent the backflow of fluid through the entry valve. Diaphragm pumps are highly used as common site in many industries. There is an extensive number of construction materials available to produce a bewildering number of configurations to accommodate difficult fluids such as corrosive chemical, volatile solvents, viscous, sticky fluids, shear-sensitive foodstuffs and pharma product dirty water and abrasive slurry smaller solids, creams, gels and oils.

Diaphragm pumps are highly used in pharmaceutical, oil & gas, food & beverages and other industries. In addition, rising demand of medicines, gasoline and other food products across the globe may act as the major driving factor for the market. Moreover, rising demand of diaphragm pump in government projects may also act as major opportunity factor for the diaphragm pump market.

The global diaphragm pump market is segmented on the basis of mechanism, operation, discharge pressure, end-user and region. Depending on mechanism, the market is categorized into air-operated and electrical-operated. On the basis of operation, it is divided into single acting and double acting. On the basis of discharge pressure, it is classified into up to 80 bars, 80 to 200 bars and above 200 bars. On the basis of end-user, it is classified into water & wastewater, oil & gas, chemicals & petrochemicals, pharmaceuticals, food & beverage and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The global diaphragm pump market is analyzed and estimated in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2020–2030. The report includes the study of the market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the diaphragm pump market growth.

Key findings of the study

On the basis of mechanism, the air-operated segment emerged as the global leader in 2020 and is anticipated to be the largest markets during the forecast period.

On the basis of operation, the double acting segment emerged as the global leader in 2020 and is anticipated to be the largest markets during the forecast period.

READ: Kribi power plant in Cameroon set for automation upgrade

On the basis of discharge pressure, the up to 80 bars segment registered the highest market share and is projected to maintain the same during the forecast period.

On the basis of end-user, the water & wastewater segment registered the highest market share and is projected to maintain the same during the forecast period.

On the basis of region, the Asia-Pacific registered the highest market share and is projected to maintain the same during the forecast period

Impact Of Covid-19 On The Global Diaphragm Pump Market

The COVID-19 pandemic has curtailed the movement of people, goods and services worldwide, including in most of the regions in which production of diaphragm pump is on large scale. As part of intensifying efforts to contain the spread of COVID-19, a number of local, state and national governments have imposed various restrictions on the conduct of business and travel, such as stay-at-home orders and quarantines that have led to a significant number of business slowdowns and closures. The COVID-19 pandemic has resulted in, and is expected to continue to result in a substantial curtailment of business activities (including the decrease in demand for a broad variety of goods and services), weakened economic conditions, supply chain disruptions, significant economic uncertainty and volatility in the financial and commodity markets, including the reduction in global demand for oil and gas combined with excessive supply due to disagreements between OPEC, both in the U.S. and abroad. However, due to the disruption in such all-mentioned activities led to decrease the demand for diaphragm pump and negatively impacted the whole market.

The manufacturing of diaphragm pump was stopped for a specific period of time due to high peak of covid1-19 situation which led to highly impact the sales of diaphragm pump.

Sales of diaphragm pump is directly proportional to the demand of oil & gas. Oil & gas has been negatively impacted amid the lockdown imposed due to the COVID-19 outbreak and recorded a huge decline in crude prices in 2020 due to the resumed overflow production. However, the continued upstream activities has not impacted the demand of diaphragm pump.

COVID-19 impacted almost all industries by hindering various industrial operations and disrupting the supply chain. Maximum companies halted their operation due to less workforce. However, there is a sluggish decline in the global diaphragm pump market due to impact of COVID-19.

According to the UNIDO, 30.0%–70.0% of pre-COVID-19 workforce of various industries, such as electrical and other third-party vendors migrated to their hometowns, due to uncertainties and loss of income during the lockdown. This unavailability or less availability of workforce is expected to directly affect the production and manufacturing activities, thereby resulting in decline in demand for raw materials used in diaphragm pump. This is expected to decline the growth of the market during the forecast period.